The U.S. economy finds itself at a pivotal juncture, as today’s release of the Consumer Price Index (CPI) report paints a picture of tempered inflationary pressures. For July 2025, the CPI registered a 2.7% increase on a year-over-year basis, slightly below expectations. On a monthly scale, prices rose by just 0.2%, mirroring forecasts. While these figures suggest a somewhat cooling inflationary environment, the path ahead for both consumers and policymakers remains uncertain.

At first glance, these numbers might seem unremarkable. However, in the complex world of economics, they tell a compelling story. The CPI, a measure of how much consumers are paying for a basket of goods and services, has been a vital gauge of economic health for decades. And while the 2.7% annual increase marks a steady climb, it is far from the dramatic spikes that have caused alarm in the past. For context, economists had anticipated a slightly higher 2.8%, indicating a smaller-than-expected inflationary surge. For those on Main Street, this news brings a measure of relief—particularly when compared to the days of rapidly rising prices that seemed to stretch budgets to their limits.

Of course, not all components of the CPI are created equal. The core CPI, which excludes the volatile food and energy sectors, showed a 0.3% increase in July, translating to a 3.1% rise year-over-year. This core reading has become a favorite metric for the Federal Reserve when gauging long-term inflationary trends, as it reflects more stable price changes. In this case, while the core CPI’s climb was slightly higher than the previous month, it still remains manageable by historical standards.

Still, the story beneath the surface is anything but simple. A closer inspection reveals a complex web of economic forces at play. The rise in shelter costs, for instance, accounted for a significant portion of the CPI’s monthly increase. Rent and home prices have been stubbornly high, creating a persistent upward pressure on the index. Meanwhile, medical care services and transportation saw increases of 0.8%, a reflection of ongoing demand and supply chain constraints in these sectors.

The Tariff Question: How Much Are They Really Impacting Prices?

One of the most significant questions arising from today’s report revolves around the impact of tariffs. For years, President Trump’s trade policies have been a focal point of debate, with critics warning that tariffs could ignite inflationary pressures. Indeed, tariffs showed up in certain categories of goods. Household furnishings and supplies, for instance, rose 0.7% in July, following a 1% increase in June. Yet, these increases were far from catastrophic. Many goods that one might expect to be hit harder by tariffs, like apparel and canned goods, saw only minimal price movements. This suggests that while tariffs are a factor, they are not driving inflation to the levels some had feared.

In fact, some experts argue that the impact of tariffs has been overstated. Jared Bernstein, a former White House economist, pointed out that while tariffs are present in the numbers, they are not yet wreaking havoc on the economy. “The tariffs are in the numbers, but they’re certainly not jumping out with a hair-on-fire effect,” he said in a recent interview. This sentiment is echoed by many economists who believe that the long-term effects of tariffs might be more subdued than initially predicted.

Nonetheless, the broader question of how tariffs will affect inflation remains open. Will their impact be a one-time spike, or will they contribute to a more sustained rise in prices? Most economists lean toward the former, arguing that tariff-induced price hikes are more likely to be short-lived as the economy adjusts. However, given the scope of the items affected by tariffs, from electronics to household goods, the concern remains that inflationary pressures could persist.

Table: Key Economic Data and Forecasts

| Metric | July 2025 | Year-over-Year Change | Forecast Comparison |

|---|---|---|---|

| Consumer Price Index (CPI) | 2.7% | +2.7% | 2.8% expected |

| Core CPI (Excluding Food/Energy) | 3.1% | +3.1% | 3.0% expected |

| Monthly CPI Change | 0.2% | N/A | 0.2% expected |

| Shelter Costs (Major Driver) | 0.2% | N/A | N/A |

| Energy Price Change | -1.1% | N/A | N/A |

| Fed Rate Cut Probability | 67% | N/A | 55% (previous) |

The Federal Reserve’s Role: A Balancing Act

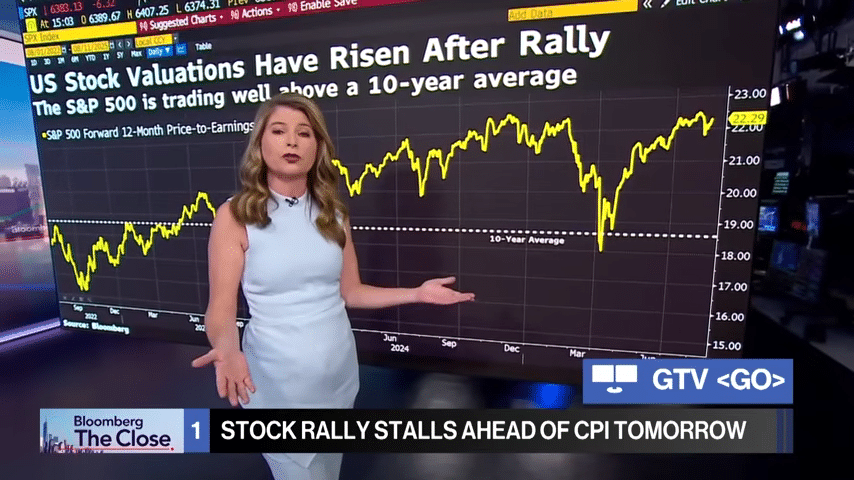

Perhaps the most significant implication of the July CPI report is its potential impact on the Federal Reserve’s monetary policy. Inflation has been a key concern for the Fed, and today’s data offers a mixed bag. While inflation has remained relatively stable, it still presents enough of a challenge to keep the central bank on alert. In particular, the core CPI’s 3.1% year-over-year increase might prompt the Fed to take action, especially if it signals a trend toward sustained inflation.

This brings us to the Fed’s next big decision: interest rates. With inflation showing signs of life, there are growing expectations that the Fed will cut rates once again. In fact, the futures market is pricing in a strong likelihood of a rate cut in September, with the probability now sitting at around 67%. This marks a notable shift from just a few months ago, when fears of runaway inflation had investors expecting rate hikes.

The rationale for a potential rate cut stems from the broader economic context. While inflation remains a concern, there are signs of weakness in the labor market. Slowing job growth and stagnant wage increases have raised red flags, suggesting that the economy may need a boost. In this environment, a rate cut could provide the stimulus needed to keep the economy on track without allowing inflation to spiral out of control.

The Economic Landscape: Resilience Amid Uncertainty

Looking beyond the immediate impact of today’s CPI report, the broader economic landscape remains a mixed bag. On one hand, the U.S. economy is showing resilience, with consumer spending holding steady and key sectors like technology and healthcare continuing to expand. On the other hand, the uncertainty surrounding trade policies, particularly tariffs, could dampen future growth prospects. Inflation-adjusted hourly earnings rose only 0.1% in July, which means that, for many workers, wages are not keeping pace with rising costs. This remains a critical challenge, especially for those in lower-income brackets who feel the pinch of inflation more acutely.

Ultimately, the July CPI report offers a snapshot of an economy that is neither booming nor faltering. Inflation is rising, but at a pace that allows for flexibility in monetary policy. The Federal Reserve has room to maneuver, and while the path ahead is fraught with challenges, it’s clear that policymakers are committed to steering the economy through uncertain waters. Whether the Fed opts for another rate cut or holds steady, it will need to carefully navigate the delicate balance between inflation and growth.

As we look ahead, the key question remains: will inflation continue to rise, or will it plateau? For now, the data suggests that the U.S. economy is treading cautiously, but steadily, towards a future where price stability and growth can coexist. Only time will tell how long this fragile equilibrium can hold, but today’s CPI report provides a glimmer of optimism in an ever-changing economic landscape.

For more in-depth coverage, visit the U.S. Bureau of Labor Statistics.